MARKET REPORT

In the above chart we can see that there is proper level breakout below 1241.50. We have given this stock below 1241.50 & it went till 1231 . Overall trend of stock was bullish on daily chart but in intraday trend was bearish and when it broke support level of 1241.50 it fall 10 point from given level .

Lot Size : 800

Market Cap : (RS CR)237,298.49

P/E Ratio : 35.23

Book Value : (RS)264.67

| Instruments | Support 1 | Support 2 | Pivot | Resistance 1 | Resistance 2 |

|---|---|---|---|---|---|

| Nifty | 11500 | 11450 | 11550 | 11580 | 11650 |

| BankNifty | 30100 | 30000 | 30200 | 30310 | 30410 |

| Gold | 32000 | 31902 | 32100 | 32200 | 32289 |

| Silver | 38200 | 37900 | 38300 | 38400 | 38648 |

| Crude | 4135 | 4100 | 4050 | 4180 | 4228 |

| Copper | 436.30 | 432.10 | 437.00 | 439.15 | 441.90 |

| Nickel | 892 | 880 | 895 | 902.00 | 913.00 |

- Commodity Report

- Stock Report

- SELL KOTAK BANK FUT BELOW 1241.50 WITH SL OF 1246.50 TGT1- 1238.30 TGT2-

In the above chart we can see that there is proper level breakout below 1241.50. We have given this stock below 1241.50 & it went till 1231 . Overall trend of stock was bullish on daily chart but in intraday trend was bearish and when it broke support level of 1241.50 it fall 10 point from given level .

Lot Size : 800

Market Cap : (RS CR)237,298.49

P/E Ratio : 35.23

Book Value : (RS)264.67 - Market Overview

Stock Analysis-UFLEX is looking bullish on chart and it is also forming swing on daily chart, stock has an immediate resistance of 330 if it manages to sustain above this level we can expect further bullishness in this counter for the upside target of 344 & 360, while on downside stock has an immediate support level @ 309 which will act as an SL to watch for.

Stock Analysis-UFLEX is looking bullish on chart and it is also forming swing on daily chart, stock has an immediate resistance of 330 if it manages to sustain above this level we can expect further bullishness in this counter for the upside target of 344 & 360, while on downside stock has an immediate support level @ 309 which will act as an SL to watch for.- Support and Resistance

Instruments Support 1 Support 2 Pivot Resistance 1 Resistance 2 Nifty 11500 11450 11550 11580 11650 BankNifty 30100 30000 30200 30310 30410 Gold 32000 31902 32100 32200 32289 Silver 38200 37900 38300 38400 38648 Crude 4135 4100 4050 4180 4228 Copper 436.30 432.10 437.00 439.15 441.90 Nickel 892 880 895 902.00 913.00

Lion of the market

With an aim to grow client’s equity consistently, we introduce Investment Advisors providing Investment and Trading recommendations with all due diligence and best Technical Analysis Research. Our focus lies in managing the risk clients are exposed to and gain most out of the trading opportunities.

Our Mission

To create successful traders and Investors throughout the country with disciplined trading and risk management tools.

Our Vision

To grow client’s equity consistently and educate clients on benefits of risk management and basic rules of trading and investing.

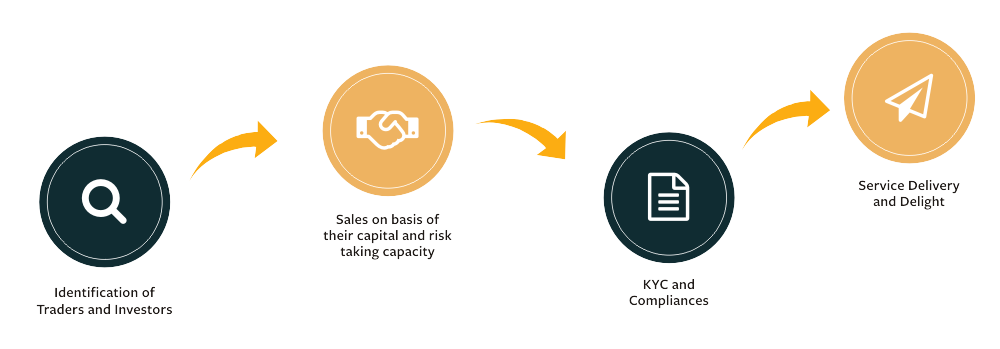

OUR PROCESS

TESTIMONIALS

At first instance I joined basic services and then saw profits, later on joined Premium services It’s around 20 days I am seeing very good Profits. Team is very active and they follow-up each minute and calls were having of 90% success rate. Even manager calls daily and asks about our feedback. The total team will be very helpful. I am really happy to be their client. I wish all the best for the team.

Mr. Ram Reddy

I am very much satisfied about Bazaarsher’s support and I made very good profit also after hearing this my friend also interested doing with you very soon. I am appreciating Rajeev’s working stlye. Tks.

Mr. Narayana Murthy